SHARIAH - COMPLIANT CONTRACT FINANCING

SME Contract Financing from RM10,000 Up To RM500,000.

NO Interest, Flexible Payment & 100% Digital.

Helping Entrepreneurs to Start Projects

Financing Up to 80% of the Contract Value

Tenor of Financing Up to 180 days

What Is Contract Financing ?

Also known as contract funding or contract finance, contract financing is a financial solution that provides businesses with the capital needed to fulfill contracts. This type of financing is especially useful for companies that have secured contracts but lack the working capital to deliver on their obligations.

How Does Contract Financing Work ?

Securing a Contract

A business secures a contract with a client, which could be a large corporation, or any other customer.

Application for Financing

The business applies for contract financing from Orpheus, providing details of the contract, including the terms, payment schedules, and the client’s creditworthiness.

Assigment Payment

The business will assign the payment of contract from client to Orpheus as Financing Company, usually within agreed-upon terms.

Assessment and Approval

We will assess the contract’s validity, the business’s capability to fulfill the contract, and the client’s reliability. Once approved, we provide a portion of the contract value as an advance.

Utilising Funds

The business uses the advanced funds to purchase materials, hire labor, or cover other expenses necessary to complete the contract.

Required Documents

- Digital copy of all Director’s Identification Card (front + back view)

- Latest 6 Months Business Account Statement

- Contract to Client

- Purchase Order and Letter of Award:

- Joint and Several Guarantee – All Directors and Shareholders

- Director’s Resolution

- Letter of Assignment / Deed of Assignment

Terms Of Financing

- Margin of Financing: Up to 80% of contract value

- Financing Amount: From RM10,000 up to RM500,000

- Tenor of Financing: Up to 180 days

- Not involved with AMLA

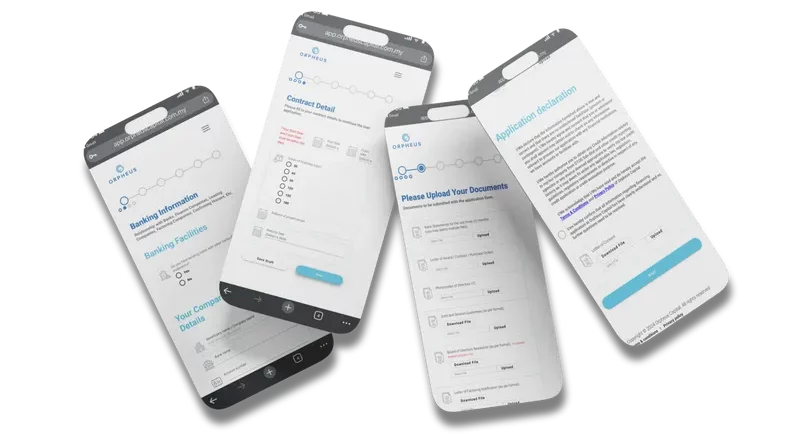

Apply Online In 10 Steps

- Register and verify your company account via email.

- Apply for Contract Financing.

- Digitally upload your business information and documentation.

- Get deed of assignment signed by contract awarder / client.

- Confirmation on application from Orpheus within 24 hours.

- You will receive an email upon approval and you are required to accept/decline the offer from the portal.

- Fill in the impact assessment page.

- Sign the Facility Agreement received via email.

- You will receive an email once the fund is successfully disbursed.

- You’ve got your Contract Financing!

Benefits of Contract Financing.

Improved Cash Flow

Provides immediate funds to cover operational costs, ensuring smooth business operations and timely contract fulfillment.

Growth Opportunities

Enables businesses to take on larger contracts or multiple contracts simultaneously, promoting business growth.

Non-Dilutive

Unlike equity financing, contract financing does not require giving up ownership or equity in the business.

Risk Mitigation

Reduces the risk of defaulting on contract obligations due to insufficient working capital.

Start Your Project.

We Help Fund Your Contract!

Our Partners