FOCUS ON YOUR BUSINESS. LET US COVER YOUR INVOICES!

SME Invoice Financing From RM10,000 Up To RM200,000.

Fully Shariah, Flexible Payment & 100% Digital.

Financing up to 80% of the Invoice Value

Minimal Services Cost

Shariah-Compliant, No Riba’

What Is Invoice Financing ?

Also known as accounts receivable financing, invoice financing is a financial service that allows businesses to borrow money against their outstanding invoices. This can provide quick access to cash, improve liquidity and support business operations.

How Does Invoice Financing Work ?

Issue Invoices:

A business sells goods or services and issues invoices to its customers with payment terms (e.g. net 30 days, net 60 days).

Select Invoices for Financing:

The business selects specific invoices it wants to use for financing and submits them to Orpheus.

Advance Payment:

We provide an advance on the invoice amount, typically 70-80% of the invoice value. This provides immediate cash flow to the business.

Assigment Payment:

The business will assign the payment of invoice from client to Orpheus as the Financing Company, usually within the agreed-upon terms.

Final Settlement:

Once the client pays the invoice, we deduct your total financing inclusive of service fees and remit the remaining balance to the business.

Required Documents

- Digital copy of all Director’s Identification Card (front + back view)

- Latest 6 Months Business Account Statement

- Invoice to client

- The following documents need to be completed and uploaded to our platform :

- Joint and Several Guarantee – All Directors and Shareholders

- Director’s Resolution

- Letter of Assignment / Deed of Assignment

Terms Of Financing

- Margin of Financing: Up to 80% of invoice value

- Financing Amount: From RM10,000 up to RM200,000

- Tenor of Financing: Up to 90 days

- Not involved with AMLA

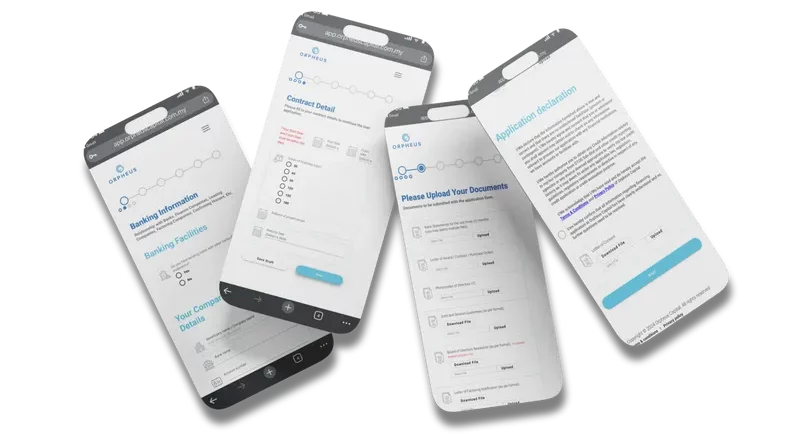

Apply Online In 10 Steps

- Register and verify your company account via email.

- Apply for Invoice Financing.

- Digitally upload your business information and documentation.

- Get deed of assignment signed by client.

- Confirmation on application from Orpheus within 24 hours.

- You will receive an email upon approval and you are required to accept/decline the offer from the portal.

- Fill in the impact assessment page.

- Sign the Facility Agreement received via email.

- You will receive an email once the fund is successfully disbursed.

- You’ve got your Invoice Financing!

Benefits of Invoice Financing

Improved Cash Flow

Immediate access to funds otherwise tied up in unpaid invoices helps businesses manage cash flow and meet operational expenses.

Flexibility

Unlike traditional loans, invoice financing can be used as needed, without long-term commitments or fixed repayment schedules.

Growth Support

Businesses can leverage invoice financing to seize growth opportunities, such as taking on larger orders or expanding operations, without waiting for customer payments.

No Debt

Since invoice financing is not a loan, it does not add debt to the business’s balance sheet. It’s essentially an advance on money already owed.

Maintaining Ownership

Businesses can secure financing without giving up equity or ownership stakes.

Get Paid Faster From Your Invoice. You Deserve It !

Our Partners