Our Strategic Partner

Secure, Swift, Simple

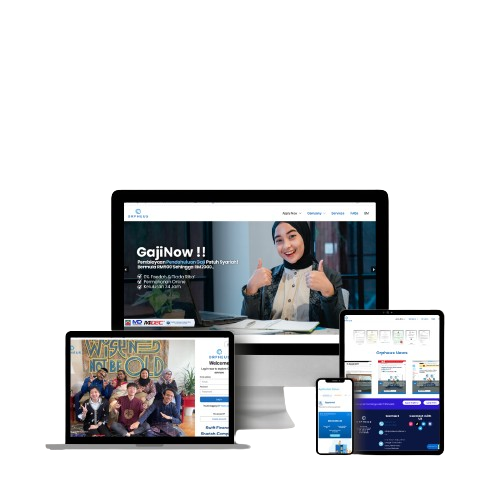

GajiNow

For salaried employee. Amount up to RM 2,500. Admin Fee starts from RM 35. Tenor up to 29 days.

How Orpheus Outperforms Traditional Financing

Secure

Conduct your transactions with peace of mind utilizing our reliable and safe systems

Swift

Receive your financing within 48 hours

Simple

Finance your business in just a few clicks with our seamless process flow

Why Choose Orpheus?

Shariah Compliant

Cash Flexibility

Financial Stress Free

No Cost To Employer

No Interest

Increased Employee Productivity

How Does Orpheus Benefits Clients?

GajiNow

Repay Ah Longs/ Loan Sharks

Bills & Comitment Repayment

Repay Family Members / Friends

SMES

Female Employee Employed

New Income Generated

Jobs oppurtunities created

Your Digital Trusted Finance Platform

Unique Scoring System

Unique algorithm systems to help you achieve better credit scores for quicker financing approval.

Internal Control System

Our systems protect the integrity of our facilities to ensure the efficiency of our operations.

CRM System

Customer Relationship Management to ensure we are serving our borrowers to the best of our abilities.

Fully Automated Debt Collection

We handle your repayments for your ease of mind.

Automated Contract Signing

Digitally sign the necessary documentation for your convenience.

Advanced eKYC

e- Know Your Customer (eKYC) Identification process completed in 4 simple steps

Fraud Mitigation System

To eliminate any risk of losses and frauds for your safety.

Reporting & Analysis Modules

Regularly reflecting on our practices in order to improve our services to you.

Verified By

Your Finance Problem Solver

Watch this video to guide your application

Repaid Ah Longs/ Loan Sharks Debt

Repaid Utility Bills

RM

MIL

New Income Generated by SMEs

Jobs created for SMEs

Our Tech

Unique algorithm systems to help you achieve better credit scores for quicker financing approval.

Our systems protect the integrity of our facilities to ensure the efficiency of our operations.

Customer Relationship Management to ensure we are serving our borrowers to the best of our abilities.

We handle your repayments for your ease of mind.

Digitally sign the necessary documentation for your convenience.

e- Know Your Customer Identification process completed in 4 simple steps

To eliminate any risk of losses and frauds for your safety.

Regularly reflecting on our practices in order to improve our services to you.

Shariah Compliant Cash Flow Solutions for SMEs & Individuals

© 2024 Orpheus • All rights reserved • Malaysia