FOCUS ON YOUR BUSINESS. LET US COVER YOUR INVOICES!

SME Invoice Financing From RM10,000 Up To RM200,000.

Fully Shariah, Flexible Payment & 100% Digital.

Financing up to 80% of the Invoice Value

Minimal Services Cost

Shariah-Compliant, No Riba’

What Is Invoice Financing ?

Also known as accounts receivable financing, invoice financing is a financial service that allows businesses to borrow money against their outstanding invoices. This can provide quick access to cash, improve liquidity and support business operations.

How Does Invoice Financing Work ?

Issue Invoices:

A business sells goods or services and issues invoices to its customers with payment terms (e.g. net 30 days, net 60 days).

Select Invoices for Financing:

The business selects specific invoices it wants to use for financing and submits them to Orpheus.

Advance Payment:

We provide an advance on the invoice amount, typically 70-80% of the invoice value. This provides immediate cash flow to the business.

Assigment Payment:

The business will assign the payment of invoice from client to Orpheus as the Financing Company, usually within the agreed-upon terms.

Final Settlement:

Once the client pays the invoice, we deduct your total financing inclusive of service fees and remit the remaining balance to the business.

Required Documents

- Digital copy of all Director’s Identification Card (front + back view)

- Latest 6 Months Business Account Statement

- Invoice to client

- The following documents need to be completed and uploaded to our platform :

- Joint and Several Guarantee – All Directors and Shareholders

- Director’s Resolution

- Letter of Assigment / Deed of Assigment

Terms Of Financing

- Margin of Financing: Up to 80% of invoice value

- Financing Amount: From RM10,000 up to RM200,000

- Tenor of Financing: Up to 90 days

- Not involved with AMLA

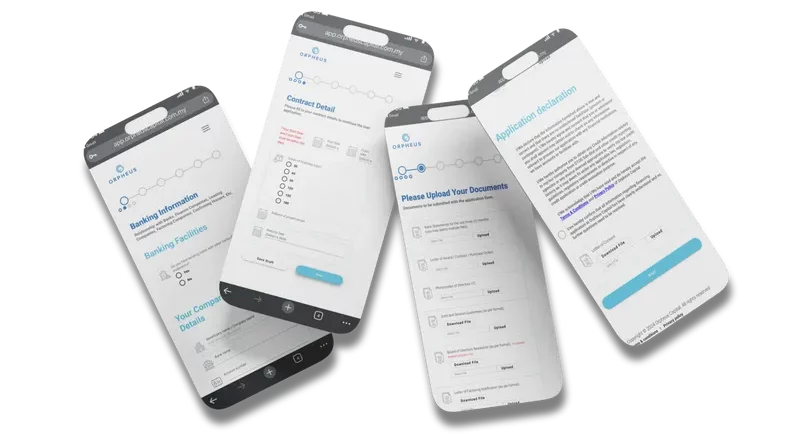

Apply Online In 10 Steps

- Register and verify your company account via email.

- Apply for Invoice Financing.

- Digitally upload your business information and documentation.

- Get deed of assignment signed by client.

- Confirmation on application from Orpheus within 24 hours.

- You will receive an email upon approval and you are required to accept/decline the offer from the portal.

- Fill in the impact assessment page.

- Sign the Facility Agreement received via email.

- You will receive an email once the fund is successfully disbursed.

- You’ve got your Invoice Financing!

Benefits of Invoice Financing.

Improved Cash Flow :

Immediate access to funds otherwise tied up in unpaid invoices helps businesses manage cash flow and meet operational expenses.

Flexibility :

Unlike traditional loans, invoice financing can be used as needed, without long-term commitments or fixed repayment schedules.

Growth Support :

Businesses can leverage invoice financing to seize growth opportunities, such as taking on larger orders or expanding operations, without waiting for customer payments.

No Debt :

Since invoice financing is not a loan, it does not add debt to the business’s balance sheet. It’s essentially an advance on money already owed.

Maintaining Ownership :

Businesses can secure financing without giving up equity or ownership stakes.

Get Paid Faster From Your Invoice. You Deserve It !

Our Partners